Weekly Recap 01.07.2023

This week’s headlines:

Is the big FTX comeback coming?

Bitcoin ETF news

Interesting Bitcoin Asset Manager theory

Positive Market Data Sparks Rate Hike Speculation

Enjoy reading and have a great weekend!

Capz

💰Crypto

Is the big FTX comeback coming?

The cryptocurrency exchange FTX is facing significant customer debt totaling $8.7 billion. However, recent reports indicate that the new management team has successfully recovered $7 billion in liquid assets, marking a significant step towards resolving the debt crisis.

The possibility of relaunching the exchange has been a topic of discussion for some time. Now, the newly appointed CEO, John J. Ray III, has confirmed the exchange's intention to embrace a complete reboot of its operations. The team is actively engaged in discussions with investors and exploring potential structures for the relaunch. One potential avenue being explored is a joint venture, as mentioned in the report. However, for any relaunch to take place, FTX would require a rebranding effort to reshape its image and establish a fresh start. Additionally, FTX has expressed its commitment to involving existing users in the relaunch, aiming to offer them a stake in the future of the exchange.

Bitcoin ETF news

The US Securities and Exchange Commission (SEC) has declared numerous spot ETF applications, including those submitted by industry giants Blackrock and Fidelity, as ineligible.

This unexpected announcement sent shockwaves through the market, triggering a wave of panic among investors and resulting in a significant sell-off and the liquidation of approximately $100 million worth of long positions.

Interestingly, the SEC's objective behind this action was to promote greater transparency within the industry. The commission sought to require asset managers to disclose their chosen exchanges for purchases and submit comprehensive "surveillance agreements" to ensure compliance and effective monitoring.

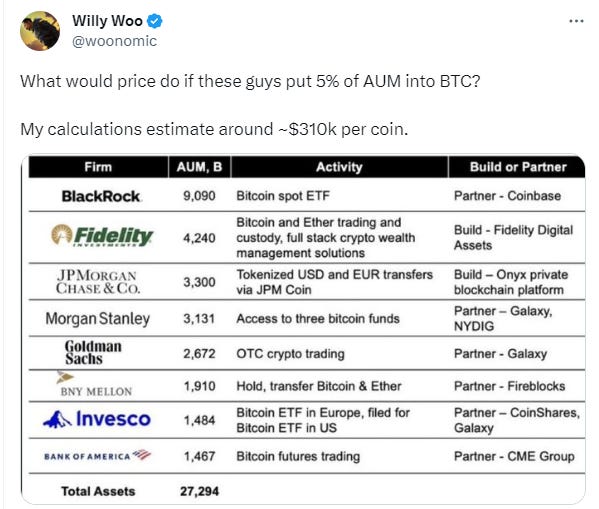

Interesting BTC asset manager theory

Personal Take: Of course, there is still a long way to go until we see institutions pouring real money into crypto. But it is still an interesting theory that I believe could turn out to be true.

Bitcoin

+1.7% in 24 hrs

-0.3% in 7 days

$30576

Ethereum

+3.8% in 24 hrs

+1.6% in 7 days

$1923

📊Traditional Markets

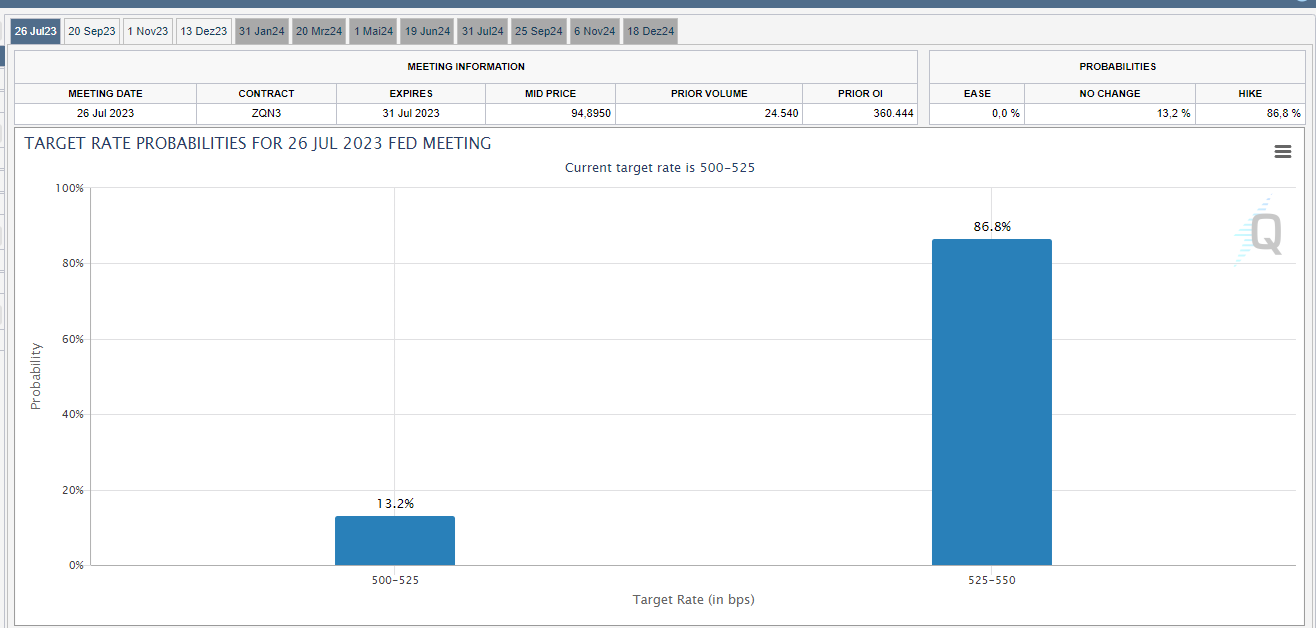

Positive Market Data Sparks Rate Hike Speculation

The final GDP figure surpassed expectations, coming in at 2%, compared to the projected 1.4% and the previous 1.3%.

Additionally, unemployment claims recorded a much lower figure than anticipated, with 239k compared to the expected 264k and the previous 265k.

At first glance, these results may seem like great news, signaling a robust economy, particularly as the S&P 500 hovers just a few percentage points away from its all-time high.

However, these positive indicators present a challenge for the Federal Reserve (FED) in its ongoing battle against inflation. The FED aims to observe the impact of its measures on the market. Yet, the data suggests that the current measures might still be too accommodating. As a result, market sentiment is increasingly inclined towards the expectation of another rate hike as early as July.

S&P 500

1.23% in 24 hrs

+2.35% in 5 days

Nasdaq 100

+1.45% in 24 hrs

+2.19% in 5 days

DAX

+1.26% in 24 hrs

+2.01% in 5 days

Disclaimer: Everything displayed in this blog post is my own opinion and does not represent financial advice in any form.